ATTENTION BARGAIN HUNTERS & INVESTORS: STOP DIGGING THROUGH WEBPAGES FOR DEALS. THEY ARE ALREADY GONE.

Get Instant, Priority Access To The Comprehensive List Of "Bank-Owned" & REO Properties In Central Maryland... Before The General Public Even Knows They Are For Sale!

DON'T SPEND A DIME WITH ANYONE TO GET A LIST OF DISTRESSED HOMES!

WE'LL SEND IT TO YOU FOR FREE!

Banks want these properties off their books fast. Discover how to scoop up these distress sales for pennies on the dollar—whether you are looking for a flip, a rental, or a dream home at a discount.

You Can See...

Foreclosures, Short Sales, REO's, Bank Owned, etc.. (Distressed Properties)

We'll Send Them To You For FREE!

From: Maryland Real Estate Professionals w/ REMAX Realty Plus

Re: Your Next Investment

Dear Deal Hunter,

If you are looking for a steal in Central Maryland, you know the frustration. You see a "Foreclosure" listing online, you call the agent, and... "Sorry, it's already under contract."

Why does this happen? Because the "Pros" have access to data that you don't. They see the Bank-Owned (REO) lists days, sometimes weeks, before they appear on public websites.

It’s time to level the playing field.

We have curated a specific "Central Maryland REO Hotlist." This is not a generic search; this is a laser-focused feed of:

Bank Foreclosures: Homes reclaimed by the lender, priced to move immediately.

Company-Owned Properties: Corporate relocation sales that need a quick exit.

Distress Sales: Pre-foreclosure situations where speed is more important than price.

"Fixer Uppers": The hidden gems ("Money Pits" to some, "Gold Mines" to you) that offer massive equity potential.

Stop fighting for the leftovers. Get the list the insiders use.

For More Info Call 1-866-623-7767

FREE Lists Of Distressed Homes!

You Do Not Have To Pay A Dime For Weekly Lists

Of Distressed Properties!

We'll Send Them To You For FREE!!!

WHY A PROFESSIONAL REALTOR TO HELP YOU LOCATE FORECLOSURES!

If you’ve been thinking about buying a distressed property—maybe a foreclosure, a short sale, or a fixer-upper—

you’ve probably realized it’s not as easy as it sounds.

Everyone talks about “finding hidden deals,” but the truth is:

distressed homes are some of the most complex transactions in real estate.

And that’s exactly why you need a professional Realtor on your side.

Let’s get real for a second. Zillow, Redfin, and other websites make it look like you

can just click around and uncover these properties on your own.

But what those platforms don’t show you is the full story—the liens, the condition issues,

the financing hurdles, the seller’s timeline, and the legal red tape that can either make or break your purchase.

This is where a Realtor becomes your advantage.

1. Access to the Right Properties

Not all distressed homes are listed in plain sight. Some are in pre-foreclosure, some are tied up in banks’ systems, and others require insider knowledge of what’s about to hit the market. A licensed Realtor has access to the Multiple Listing Service (MLS) and professional networks that aren’t available to the public. That means you get first-hand knowledge of opportunities before they’re gone.

2. Navigating the Complex Paperwork

Distressed property sales often involve extra layers of documentation. Lenders, attorneys, banks, and sellers each have their own requirements. A Realtor helps you navigate this maze, making sure nothing slips through the cracks. One missed detail could delay your purchase—or cost you the home altogether.

3. Protecting Your Interests

Buying distressed properties comes with risk. Some homes may have structural issues. Others may carry unpaid taxes or liens. A Realtor knows what to look for and connects you with inspectors, contractors, and title professionals who can uncover the real condition of the home before you sign anything. You deserve to know exactly what you’re walking into.

4. Negotiation Power

Here’s the truth: distressed home transactions aren’t about “lowballing.” They’re about smart, strategic offers that balance value with the seller’s (or bank’s) needs. Realtors are trained negotiators. They know when to push, when to pause, and how to structure an offer so it gets serious consideration.

5. Saving You Time and Stress

Yes, you could try to do this yourself. But do you really want to spend months chasing incomplete information, making offers that don’t get accepted, or dealing with paperwork that makes your head spin? A Realtor’s job is to streamline the process, eliminate the guesswork, and help you move forward with confidence.

Buying a distressed home can be one of the smartest financial moves you’ll ever make—but only if it’s done the right way. And the right way starts with having a professional Realtor in your corner.

If you’re serious about finding these opportunities without wasting time, money, or energy, it’s time to partner with a Realtor who understands the process inside and out.

Because in today’s market, “DIY” isn’t a strategy. It’s a gamble.

For More Info

Call 1-866-623-7767

BONUS:

FREE CUSTOM HOME SEARCH!

SEE THE HOMES THAT YOU WANT TO SEE!

WHEN YOU WANT TO SEE THEM!

RIGHT IN YOUR INBOX!

SOMETIMES BEFORE THEY

COME ON THE MARKET!

Get a headstart over other home buyers!

Are you searching for your

dream home in Maryland?

Don’t miss out on your exclusive opportunity to access our

FREE Custom Coming Soon Home Search, brought to you by the local experts at Maryland Real Estate Professionals.

You’ll get early access to listings in Mount Airy, New Market, Ijamsville, Monrovia, and Frederick – before they hit the major websites!

For More Info

Call 1-866-623-7767

You Can See...

Foreclosures, Short Sales, REO's, Bank Owned, etc.. (Distressed Properties)

We'll Send Them To You For FREE!

BEFORE YOU START LOOKING AT HOMES...

YOU NEED TO KNOW HOW MUCH HOME YOU CAN AFFORD!

GET PRE-APPROVED!

Dan Flavin

Maryland Manager

410-935-3528 - Cell

NMLS ID 112267

Licensed: MD, VA, DC, DE

Apply Online To Get Pre-Qualified

Geoff Ricker

Senior Loan Officer

443-532-1620 - Cell

NMLS ID 455886

Licensed: MD, VA, PA, DE

Apply Online To Get Pre-Qualified

Gary Neus

Producing Branch Manager

717-372-6538 - Cell

NMLS ID 433569

Licensed: MD, VA, DC, DE

Apply Online To Get Pre-Qualified

For More Info Call

1-866-623-7767

WHY WORK WITH MARYLAND REAL ESTATE PROFESSIONALS?

For More Info - Call 1-866-623-7767

Mark assisted us with a complicated situation, showing initiative and creative thinking as we navigated complex dynamics with many rounds of negotiations. He was prompt to reply and quick to follow up, we were very happy with his advice which was always in our best interest and leveraged years of experience.

- Dan R.

For More Info Call 1-866-623-7767

How Much Home You Can Afford!

🧭 Why Getting Pre-Qualified First Is So Important

❌ Don’t Start With the House — Start With the Loan

Most buyers jump straight to searching for homes online. But without knowing your budget, you're setting yourself up for stress, disappointment, or missed opportunities.

Instead, our process starts with one simple but crucial question:

How much house can you actually afford?

That answer will guide:

Where you search

What you offer

Which loan programs you qualify for

How fast you can close

⭐ Testimonials

“I had no clue how much home I could afford until I read this report.

Turns out, I was pre-approved for more than I expected—and I’m now a homeowner!”

— Ryan C., New Market

“They explained everything in plain English and helped me

find a lender who got me pre-approved in 48 hours.”

— Lisa M., Ijamsville

“I almost bought too soon. This free report saved me from a huge

mistake—and helped me buy smarter.”

— Jen R., Frederick

✅ Ready to Find Out How Much You Qualify For?

You don’t have to guess. You don’t have to stress.

Get the facts. Get pre-qualified. Get moving.

👉 Visit www.HowMuchLoan.com

💼 Central Maryland Real Estate Opportunities – CentralMDREOs.com

Welcome to CentralMDREOs.com, your trusted source for buying, selling, and investing in Central Maryland real estate. Whether you’re a first-time homebuyer, experienced seller, or investor looking for bargains, Maryland Real Estate Professionals at REMAX Realty Plus are here to guide you every step of the way.

Why Work with Maryland Real Estate Professionals

Working with licensed Maryland Real Estate Professionals ensures your transaction is handled with care, compliance, and expertise.

Professional Knowledge of the Market

Our Realtors know the Central Maryland housing market inside and out.

Personalized Guidance for Every Client

From first-time homebuyers in Ijamsville to investors seeking distressed properties in New Market, our team provides tailored support.

Backed by REMAX Realty Plus

By choosing REMAX Realty Plus, you’re working with one of the most respected real estate brands worldwide—combined with the local knowledge you need.

Communities We Serve

We specialize in helping buyers, sellers, and investors in:

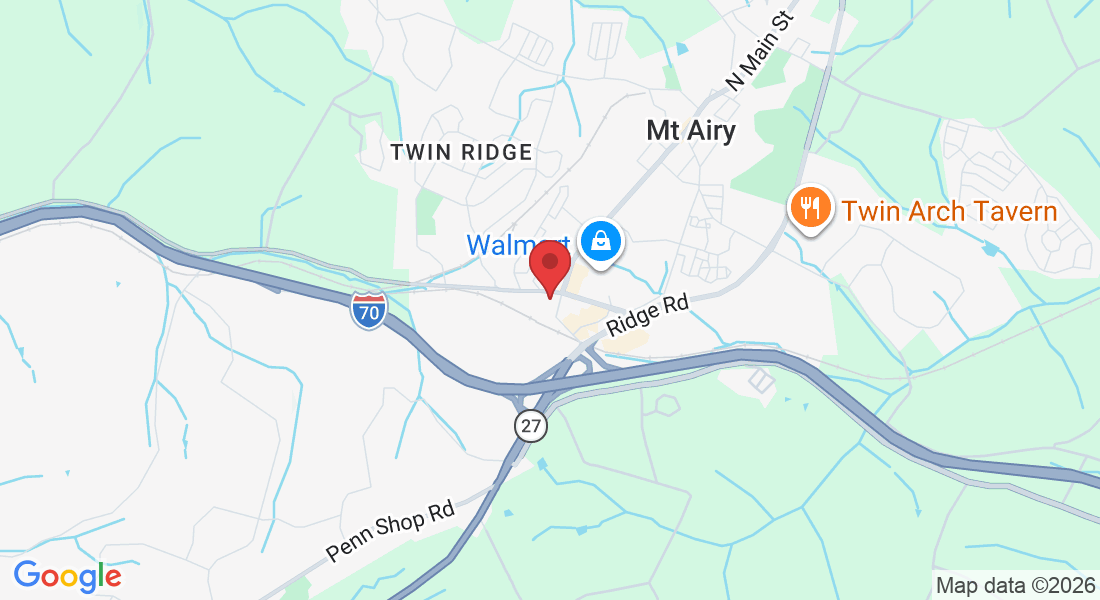

Mount Airy (Mt. Airy)

Historic charm, commuter convenience, and diverse housing options make Mount Airy one of Central Maryland’s most attractive towns.

New Market

Known as the “Antiques Capital of Maryland,” New Market offers both historic homes and new developments.

Monrovia

With its affordability and accessibility, Monrovia is popular among families and first-time buyers.

Ijamsville

Quiet living, top-rated schools, and high demand make Ijamsville an excellent choice for buyers and sellers alike.

Why CentralMDREOs.com is Different

Free Reports & Resources

Access free, no-obligation guides covering home buying, selling strategies, and investment opportunities.

Bargain Home Listings

Learn about foreclosures, REOs (Real Estate Owned properties), and homes priced below market value.

Local Insights

Stay updated with accurate information on Central Maryland real estate, including Mount Airy, New Market, Monrovia, and Ijamsville.

Support for Home Buyers

Tailored Marketing Plans

From professional photography to online exposure, our Realtors position your home for success.

Avoid Costly Mistakes

Our free reports show sellers how to maximize value while minimizing stress.

Support for Real Estate Investors

Find Profitable Opportunities

Investors gain access to REO and foreclosure listings not always visible on major search sites.

Expert Evaluation

Maryland Real Estate Professionals at REMAX Realty Plus help analyze rental potential, resale value, and return on investment.

Our Commitment to Compliance & Ethics

We follow Maryland and U.S. real estate laws, including the Fair Housing Act. Our Realtors provide fair, equal service to every client—regardless of race, color, religion, sex, handicap, familial status, or national origin.

Why Choose a Realtor with REMAX Realty Plus

Not every agent is a Realtor. By working with a licensed Realtor at REMAX Realty Plus, you gain:

Training and experience in Maryland real estate law.

Access to powerful marketing and listing tools.

Local knowledge of Central Maryland communities.

Take the Next Step

Whether you’re buying, selling, or investing, your next move matters. Start with trusted information and proven professional guidance.

📘 Download your free report today at www.CentralMDREOs.com or connect directly with Maryland Real Estate Professionals at REMAX Realty Plus.

When You Work With

The Maryland Real Estate Professionals Team...

You Get:

- FREE Drone Video and Pics

- FREE Virtual Tours

- FREE Custom URL

- FREE Webpage

- FREE Marketing and Advertising

and so much more.

FREE MARKETING!

When you work with the Maryland Real Estate Professionals Team (w/ REMAX Realty Plus) we put our 25 years of marketing experience to work on your behalf. FREE Drone video and Pics, FREE Custom URL and Webpage. FREE Social Media Marketing on all the pages that we own! Your house will get plenty of exposure!

FREE HOME SEARCH!

SEE THE HOMES YOU WANT TO SEE! WHEN YOU WANT TO SEE THEM!

RIGHT IN YOUR INBOX!

No more surfing the net, hoping the information was accurate. No more filling out forms, and having your information sold to desperate realtors and lenders. We promise we will never sell your information! NEVER!

EXPERIENCE!

Experience matters when it comes to real estate. Do you want someone new helping you negotiate your most valuable asset, or someone with years of experience and tons of negotiation skills working on your behalf! With over 25 years in the industry, we know the market, we know most of the players and we know how to negotiate!

For More Info

Call 1-866-623-7767

Post Address and Mail

Email: [email protected]

Site: www.MarylandRealEstateProfessionals.com

Phone Number:

301-418-8640 - C

301-831-5600 - O

Address

Office:

1502 S. Main St. Ste 203

Mount Airy, MD 21771

Assistance Hours

Mon – Sun 9:00am – 8:00pm

For More Info Call

1-866-623-7767

Website created by:

iQJEM: Smart Marketing Solutions....

For Your JEM Of A Business!